The DC Housing Crisis vs 30,000 Vacancies in DC. . . What is Going On?

The vacancy information for Washington, D.C. below is based on the 2019 American Housing Survey (AHS) which is conducted biennially by the U.S. Census.

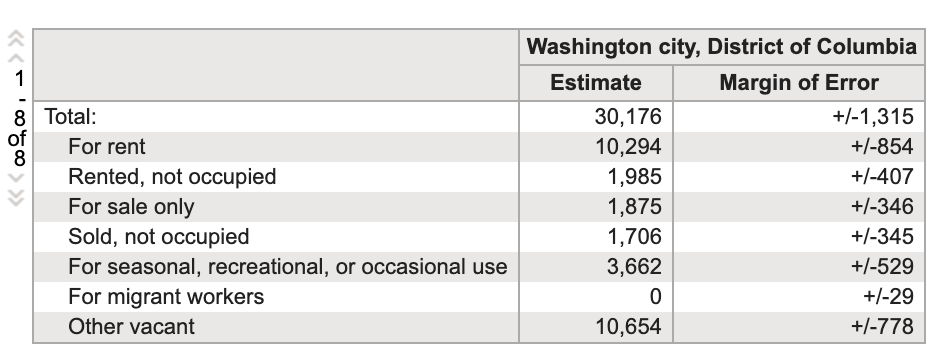

This AHS survey asks landlords about vacancy status, resulting in this table below (Table: B25004) representing a timeframe of 60 months of collected data. There are also 1-year and 3-year estimates.

The Metropolitan Statistical Area (MSA) is the smallest level at which the survey reports data.

How can there be 30,000 vacant units when we have a housing crisis?

Thirty thousand vacant units counted! This fact destroys any assumption that building more luxury housing will eventually result in lower cost housing units trickling down in what growth supporters call, “Filtering.”

The D.C. Chief Financial Officer has a bit more of a conservative number of vacant housing units, 10,000. Either way, that’s thousands of vacant units existing pre-Covid that could house our homeless veterans, mothers, families, children, people who are facing homelessness, etc., especially now during the pandemic. See Vacant to Virus Reduction site.

Luxury Units Stay Empty Without Any Market Corrections

Luxury units for investment (lots of it foreign) results in developer demand for upzoning to increase buildable density without providing housing to be lived in. What is the good of new housing being kept uninhabited by investors? It stifles free market supply-and-demand and keeps prices of housing high, while allowing bankers and the construction industry to profit.

Empty housing units are also tax liabilities that can be written off by mega real estate speculators at the end of the year, equaling a form of income. Thus, the myth of the effect of supply-and-demand on housing is exposed as the tax write-offs for empty units completely nullifies any market corrections.

Foreign Investment in Luxury Housing Creates Exclusive New Communities in DC With High Vacancies

U.S. real estate remains attractive for illicit money from all over the world. In DC, that foreign money invests into planning officials follies, like the dramatic changes at Union Market in Northeast. #UnionMarketExclusive

It’s a stable investment that generally maintains or grows in value – and it gives corrupt oligarchs and dictators a potential escape route if they’re ousted from their home countries.

But this money drives out honest purchasers and makes cities hotbeds for dirty, unproductive cash. It turns cities and communities into commodities.

In one part of New York City, for example, the Census Bureau estimated that 30 percent of apartments are unoccupied most of the year.

Whomst really are we subsidizing, constructing, and housing in all these giant luxury boxes? Case in point: #SWWaterfrontExclusive

— Chris R. Otten (@rotten4eva) February 20, 2020

Can we shift #36000×2025 to only #6000×2025 and fill up all these luxury vacancies?@MayorBowser @ChmnMendelson @AnitaBondsDC @RobertWhite_DC pic.twitter.com/gDamulmBST

Legislation is needed to require habitation of units built. After all, owners are not permitted to keep houses vacant on the streets of DC. Why should it be different with condo or apartment buildings?

COVID UPDATE JUNE 2020

COVID UPDATE AUG 2020

The Washingtonian, August 3, 2020 — NoMa and H Street apartments are experiencing an 8.2 percent vacancy rate, while developments in Navy Yard and Southwest are seeing 7.7 percent vacancy. The vacancy rates in those areas were less than 5 percent at the same time last year. District-wide, the average vacancy rate in luxury apartments is currently 6.8 percent, compared to 4.1 percent last year.